Subex Share Price Target 2025, 2026, 2030, 2040, 2050

Subex Ltd, established in 1992, is an industry-leading software company focused on Digital Trust. Through our emphasis on privacy, security, risk mitigation, and data trust, we serve communication service providers (CSPs) worldwide with focused offerings, including Business Assurance, Network Analytics, Fraud and Security Management Services, IoT Security solutions, and AI Services.

This blog will discuss its Subex share price targets as far as 25 years from now (2025 – 2050).

What is Subex Ltd? NSE: SUBEXLTD

Subex Ltd is a leading software product company specializing in Digital Trust. CEO Nisha Dutt heads Subex, whose vision is to assist customers in developing next-generation use cases, enhance customer experiences, and address the complexities associated with IoT and 5G networks. Subex’s role is to be a trusted partner in telecom transformation.

Subex has advanced with technological innovation from video telephony to 5G. It remains at the forefront through its Hypersense platform based on artificial intelligence and generative AI. Today, Subex operates across 90 countries with 300 installations serving diverse industries like manufacturing, public services, smart cities, and oil and gas.

Subex has over 200 customers, including Airtel, Jio, and Optus, and has attained an exceptional customer retention rate of 98%. Subex’s revenue model encompasses managed services, support services, and implementation, with annuity-based revenue being its focus. Furthermore, they are exploring opportunities within account aggregation services following RBI approval to diversify revenue streams further.

Subex Ltd – Fundamental Table

| Metric | Value |

|---|---|

| Market Capitalization | ₹1,227 Cr. |

| Current Price | ₹21.8 |

| High / Low | ₹45.8 / ₹21.1 |

| Stock P/E | – |

| Book Value | ₹5.75 |

| Dividend Yield | 0.00% |

| ROCE | -5.48% |

| ROE | -12.2% |

| Face Value | ₹5.00 |

| Industry PE | 43.0 |

| Net CF (PY) | ₹-33.0 Cr. |

| PBT (Yearly) | ₹2.99 Cr. |

| EPS | ₹-3.05 |

| Promoter Holding | 0.00% |

| PEG Ratio | – |

| Net Profit | ₹-172 Cr. |

| Debt | ₹24.5 Cr. |

| Dividend Last Year | ₹0.00 Cr. |

| Current Liabilities | ₹106 Cr. |

| Current Assets | ₹233 Cr. |

| Debt to Equity | 0.08 |

| Price to Book Value | 3.79 |

| Graham Number | – |

Key Metric Table

| Metric | Value |

|---|---|

| Sales (Yearly) | ₹308 Cr. |

| Operating Profit (Yearly) | ₹-0 Cr. |

| Compounded Sales Growth (5 Years) | -2.31% |

| Compounded Profit Growth (5 Years) | – |

| Stock Price CAGR (5 Years) | 28% |

| Return on Equity (ROE) – 5 Years | -5.44% |

| Cash from Operating Activity | ₹-8 Cr. |

Peer Comparisons

| S.No. | Name | CMP Rs. | P/E | Market Cap Rs. Cr. | Dividend Yield % | Net Profit (Qtr) Rs. Cr. | Qtr Profit Var % | Sales (Qtr) Rs. Cr. | Qtr Sales Var % | ROCE % |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Oracle Fin.Serv. | ₹12,001.15 | 41.75 | ₹1,04,186.33 | 2.00 | ₹577.70 | 38.39 | ₹1,673.90 | 15.88 | 39.54 |

| 2 | PB Fintech. | ₹2,120.00 | 562.06 | ₹97,398.77 | 0.00 | ₹50.98 | 350.35 | ₹1,167.23 | 43.81 | 1.75 |

| 3 | Coforge | ₹9,631.75 | 81.69 | ₹64,397.63 | 0.79 | ₹233.60 | 11.71 | ₹3,062.30 | 34.54 | 28.60 |

| 4 | Tata Elxsi | ₹6,486.45 | 49.46 | ₹40,400.69 | 1.08 | ₹229.43 | 14.70 | ₹955.09 | 8.32 | 42.74 |

| 5 | KPIT Technologies | ₹1,451.70 | 54.84 | ₹39,813.93 | 0.46 | ₹203.75 | 45.30 | ₹1,471.41 | 22.70 | 38.36 |

| 6 | Tata Technologies | ₹876.40 | 54.90 | ₹35,517.14 | 0.96 | ₹157.41 | -1.85 | ₹1,296.45 | 2.15 | 28.29 |

| 7 | Inventurus Knowl | ₹1,867.35 | 86.49 | ₹32,036.23 | 0.00 | ₹208.58 | – | ₹1,282.88 | 103.35 | 30.01 |

| 8 | Subex | ₹21.78 | – | ₹1,227.17 | 0.00 | ₹0.62 | 88.87 | ₹74.16 | 74.16 | -5.48 |

| Period | Share Price (INR) |

|---|---|

| Before 1 Year | ₹41.45 |

| Before 6 Months | ₹30.45 |

| Before 5 Years | ₹6.20 |

| All-Time Max | ₹721.00 |

Today, Subex’s share price reflects market sentiment, which is determined by financial performance, industry trends, and recent developments at the company. Subex has achieved several significant positive milestones since being listed, such as global telecom AI solutions and debt reduction; however, challenges such as declining sales growth or negative return on equity may erode investor trust and share price performance. Market News may also play a part in its performance.

Check Live Price here:

Tomorrow’s Subex share price may fluctuate based on investors’ responses to its latest business announcements and financial position. Positive momentum may originate from digital trust initiatives or global telecom partnerships. Conversely, low-profit margins or robust industry competition could soak sentiment and cause cautious market behavior.

| Price Type | Change |

|---|---|

| Maximum | +₹0.60 |

| Minimum | -₹0.35 |

SUBEX Indicator Based Technical Analysis

NOTE!

Signals may differ across timeframes. If you’re planning to purchase SUBEX and keep it for more than one week, it’s suggested that you choose signals from weekly and daily timeframes. For trading in the short term, signals that range from 5 minutes to 1-hour timeframes are better appropriate.

Subex is estimated to set its 2025 price target between Rs16 and Rs48, reflecting its focus on digital trust, AI-driven innovation, and global telecom partnerships. The Share Price within this range requires strong customer retention strategies, increased revenue from IoT services such as 5G services, and a characterization of account aggregators and emerging tech markets.

| Year | Minimum Price (₹) | Maximum Price (₹) | Remarks |

|---|---|---|---|

| 2025 | 16 | 48 | Growth driven by AI and telecom focus. |

| Month | Minimum Price (₹) | Maximum Price (₹) | Remarks |

|---|---|---|---|

| January | 16 | 32 | Post-Q3 impact likely. |

| February | 16 | 34 | New developments anticipated. |

| March | 17 | 36 | Year-end results influence prices. |

| April | 18 | 38 | Telecom demand may drive growth. |

| May | 20 | 40 | Strategic initiatives boost optimism. |

| June | 18 | 41 | Seasonal factors may affect prices. |

| July | 20 | 42 | H1 performance sustains momentum. |

| August | 22 | 43 | Pre-Q2 earnings expectations rise. |

| September | 20 | 44 | AI adoption supports growth. |

| October | 18 | 42 | Competition may create pressure. |

| November | 19 | 44 | Positive outlook ahead of Q2 results. |

| December | 22 | 45 | Year-end projects drive optimism. |

Subex share prices are projected to reach Rs20-55 by 2026, driven by AI-enabled telecom solutions, IoT security expansion, and 5G network management revenues. Future growth will depend on scaling Hypersense platform usage, diversifying into fintech sectors, and global digital transformation trends.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2026 | 20 | 55 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 20 | 35 |

| February | 22 | 38 |

| March | 24 | 40 |

| April | 25 | 42 |

| May | 28 | 44 |

| June | 26 | 46 |

| July | 28 | 48 |

| August | 30 | 50 |

| September | 32 | 52 |

| October | 30 | 50 |

| November | 32 | 53 |

| December | 34 | 55 |

By 2030, Subex’s share price may experience significant expansion, reaching Rs130-Rs210 as its expansion into AI, IoT security and 5G solutions continues. Telecommunications and digital transformation are rapidly progressing; Subex’s innovative products and strong customer base will contribute significantly to long-term revenue growth and market success.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 130 | 210 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 130 | 140 |

| February | 135 | 145 |

| March | 140 | 150 |

| April | 145 | 160 |

| May | 150 | 170 |

| June | 155 | 180 |

| July | 160 | 190 |

| August | 165 | 200 |

| September | 170 | 205 |

| October | 175 | 210 |

| November | 180 | 205 |

| December | 185 | 210 |

Subex’s share price could skyrocket by 2040 thanks to breakthrough advances in quantum computing, blockchain for telecom security and AI-driven 5G network optimization. Plus, it is expanding into smart city solutions and financial technology services: Subex is primed to lead digital transformation while guaranteeing long-term growth. The Share prices are expected to range from ₹400 to ₹600 by 2040.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 400 | 600 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 400 | 420 |

| February | 420 | 440 |

| March | 440 | 460 |

| April | 460 | 480 |

| May | 470 | 490 |

| June | 480 | 510 |

| July | 490 | 520 |

| August | 500 | 530 |

| September | 510 | 540 |

| October | 520 | 550 |

| November | 530 | 570 |

| December | 550 | 600 |

Subex’s share price could reach Rs1,,000-Rs1,500 by 2050 due to their work in AI-powered quantum networks, blockchain digital identity solutions, and global 6G infrastructure. Subex will capitalize on emerging technologies to drive exponential growth and market dominance.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 1000 | 1500 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 1000 | 1050 |

| February | 1050 | 1100 |

| March | 1100 | 1150 |

| April | 1150 | 1200 |

| May | 1180 | 1250 |

| June | 1200 | 1300 |

| July | 1250 | 1350 |

| August | 1300 | 1400 |

| September | 1350 | 1450 |

| October | 1400 | 1500 |

| November | 1450 | 1500 |

| December | 1500 | 1500 |

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 16 | 48 |

| 2026 | 20 | 55 |

| 2030 | 130 | 210 |

| 2040 | 400 | 600 |

| 2050 | 1000 | 1500 |

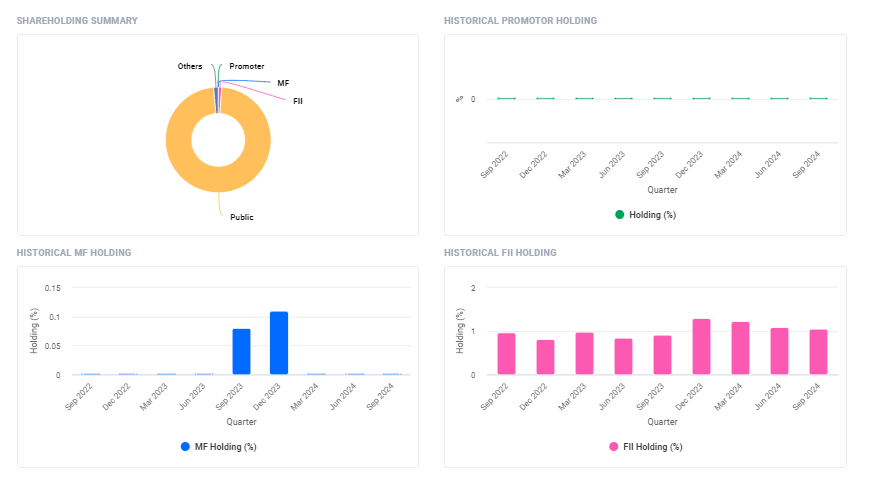

| Category | Sep 2024 |

|---|---|

| FIIs + | 1.06% |

| DIIs + | 0.01% |

| Public + | 97.57% |

| Others + | 1.38% |

| No. of Shareholders | 3,69,636 |

- FII/FPI investors reduced their holdings from 1.08% to 1.06% during the September 2024 quarter and remained unchanged at 33 investors.

- Institutional investors saw their holdings decline from 1.09% to 1.07% during that quarter.

Should I Buy Subex Stock?

Subex has significantly decreased its debt to Rs24.5 Cr and is focused on telecom AI for approximately 75% of leading telecom companies globally. Unfortunately, Subex reported a net loss of Rs172 Cr for FY23 with an ROCE average of -5.48% over five years; currently trading at 3.79x book value, this remains a hazardous investment option.

✔Infibeam Avenues Share Price Target 2025, 2026, 2030, 2040, 2050

✔ Mobikwik Share Price Target 2025, 2026, 2030, 2040, 2050

Subex Ltd Earnings Results

| Particulars | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | Sep 2022 | Jun 2022 | Mar 2022 | Dec 2021 | Sep 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sales (₹ Cr) | 74.16 | 68.16 | 83.80 | 81.82 | 76.81 | 67.29 | 47.27 | 73.66 | 74.50 | 83.26 | 78.80 | 87.74 | 86.30 |

| Expenses (₹ Cr) | 72.27 | 74.20 | 80.72 | 81.24 | 81.38 | 82.03 | 84.03 | 68.57 | 74.19 | 82.55 | 77.79 | 79.71 | 76.40 |

| Operating Profit | 1.89 | -6.04 | 3.08 | 0.58 | -4.57 | -14.74 | -36.76 | 5.09 | 0.31 | 0.71 | 1.01 | 8.03 | 9.90 |

| OPM (%) | 2.55% | -8.86% | 3.68% | 0.71% | -5.95% | -21.91% | -77.77% | 6.91% | 0.42% | 0.85% | 1.28% | 9.15% | 11.47% |

| Other Income (₹ Cr) | 5.42 | 1.92 | -145.26 | 1.41 | 1.28 | 1.35 | 3.72 | 0.81 | 0.98 | 2.65 | 2.00 | 0.69 | 0.97 |

| Interest (₹ Cr) | 0.59 | 0.59 | 0.64 | 0.63 | 0.66 | 0.70 | 0.72 | 0.76 | 0.82 | 0.28 | 0.32 | 0.88 | 0.33 |

| Depreciation (₹ Cr) | 3.73 | 3.66 | 3.78 | 3.75 | 4.20 | 3.87 | 3.82 | 3.81 | 3.75 | 2.61 | 2.48 | 2.52 | 2.46 |

| PBT (₹ Cr) | 2.99 | -8.37 | -146.60 | -2.39 | -8.15 | -17.96 | -37.58 | 1.33 | -3.28 | 0.47 | 0.21 | 5.32 | 8.08 |

| Tax (%) | 79.26% | 33.93% | 6.76% | 104.60% | 35.58% | 7.35% | 25.55% | 451.88% | 49.39% | -1,078.72% | -190.48% | 60.90% | 40.35% |

| Net Profit (₹ Cr) | 0.62 | -11.21 | -156.51 | -4.89 | -11.05 | -19.28 | -47.18 | -4.68 | -4.90 | 5.54 | 0.61 | 2.08 | 4.82 |

| EPS (₹) | 0.01 | -0.20 | -2.78 | -0.09 | -0.20 | -0.34 | -0.84 | -0.08 | -0.09 | 0.10 | 0.01 | 0.04 | 0.09 |

Subex’s Q2 FY24 results include revenue of Rs74.16 Cr and net profit of Rs0.62 Cr, a slight improvement from losses in prior quarters. Operating profit margin stood at 2.55%; expenses remained high, but revenues stabilised. Subex is trying to improve profitability and reduce financial volatility.

Expert Forecasts On The Future Of Subex Ltd.

Subex Limited must overcome numerous challenges to reach growth, such as its 5-year sales decline of -2.31% and return on equity of -12.2%. While debt was reduced to Rs24.5 Cr, expenses continue to limit profits. AI in telecom is one area that may offer growth potential; 75% of top telecom companies already use this technology as customers.

Is Subex Stock Good to Buy? (Bull case & bear case)

Bullish Case:

- The company is nearly debt-free at a debt level of Rs24.5 Cr.

- AI in telecoms has long been one of the area’s primary focus areas and is trusted by over 75% of the leading telecoms firms worldwide.

- Potential for growth through innovation and partnerships.

Bearish Case:

- Turnover dropped by 2.31 per cent over five years.

- Negative Return On Equity (-12.2%) and Unpredictable Profits.

- Traded at 3.79 times its book value and considered expensive.

Conclusion

Subex Ltd. shows promise with its AI focus in telecoms and partnerships with global companies, as well as declining sales, losses and negative return on equity. However, these challenges should make investors wait until higher profitability and more vigorous growth before considering purchasing this stock.