MTNL Share Price Target 2025, 2026, 2030, 2040, 2050

Mahanagar Telephone Nigam Limited (MTNL) is a public sector company established in 1986 to offer telecom services across India at affordable and quality levels.

MTNL operates predominantly in the Delhi-NCR and Mumbai-Thane districts. International operations extend to Mauritius through a subsidiary, while Nepal via a joint venture. Unfortunately, its limited geographic reach makes competing with nationwide telecom providers much harder.

This blog will discuss its MTNL share price targets as far as 25 years from now (2025 – 2050).

What is Mahanagar Telephone Nigam Ltd NSE: MTNL?

Mauritius Telecommunications Network Limited’s subsidiary offers mobile, internet and international long-distance services. It relies heavily on local outsourcing for many of its operations. Unfortunately, its joint venture in Nepal is experiencing financial losses and customer drop-off.

Over the years, MTNL has faced serious difficulties. Customer numbers have decreased due to outdated technology and extreme competition within the telecom sector, further compounded by insufficient investments made towards network modernization

MTNL was left burdened with an enormous debt load of Rs26,800 Cr. at the close of FY22. Financial constraints prevented it from modernising or expanding services offered, leading many planned projects to be delayed or put on hold.

Despite these challenges, MTNL remains one of India’s first public sector telecom providers and continues to provide essential telecom services.

Fundamental Table

| Metric | Value |

|---|---|

| Market Capitalization | ₹2,849 crore |

| Current Price | ₹45.15 |

| High / Low (52 weeks) | ₹102 / ₹31.2 |

| Stock P/E | N/A (due to negative earnings) |

| Book Value | ₹-401 |

| Dividend Yield | 0.00% |

| ROCE | -8.18% |

| ROE | N/A |

| Face Value | ₹10 |

| Industry PE | 51.6 |

| Net Cash Flow (PY) | ₹67.1 crore |

| PBT (Quarterly) | ₹-890 crore |

| EPS | ₹-52.2 |

| Promoter Holding | 56.2% |

| PEG Ratio | N/A |

| Net Profit (Annual) | ₹-3,287 crore |

| Debt | ₹31,203 crore |

| Dividend (Last Year) | ₹0.00 crore |

| Current Liabilities | ₹11,625 crore |

| Current Assets | ₹5,477 crore |

| Debt-to-Equity Ratio | N/A |

| Price-to-Book Value | N/A |

| Graham Number | N/A |

Key Financials

| Metric | Value |

|---|---|

| Sales | ₹799 Cr. (FY 2024) |

| Operating Profit | ₹-481 Cr. (FY 2024) |

| Compounded Sales Growth (5 Years) | -17% |

| Compounded Profit Growth (5 Years) | 1% |

| Stock Price CAGR (5 Years) | 33% |

| Return on Equity (ROE) – 5 Years | – |

| Cash from Operating Activity | ₹130 Cr. (FY 2024) |

Peer Comparisons

| S.No. | Name | CMP Rs. | P/E | Mar Cap Rs.Cr. | NP Qtr Rs.Cr. | Qtr Profit Var % | Sales Qtr Rs.Cr. | Qtr Sales Var % | ROCE % |

|---|---|---|---|---|---|---|---|---|---|

| 1. | Bharti Airtel | 1615.90 | 68.22 | 967434.53 | 4153.40 | 119.37 | 41473.30 | 11.96 | 13.13 |

| 2. | Bharti Hexacom | 1452.75 | 77.36 | 72684.29 | 253.10 | 194.62 | 2097.60 | 20.66 | 13.98 |

| 3. | Vodafone Idea | 7.75 | 53949.24 | -7175.90 | 17.88 | 10932.20 | 2.01 | -3.61 | |

| 4. | Tata Comm | 1725.00 | 60.11 | 49162.50 | 227.27 | -2.32 | 5767.35 | 18.37 | 17.55 |

| 5. | Tata Tele. Mah. | 69.46 | 13569.62 | -330.39 | -6.50 | 343.50 | 19.76 | 47.91 | |

| 6. | Railtel Corpn. | 379.25 | 43.19 | 12170.07 | 72.64 | 8.14 | 843.49 | 40.78 | 20.25 |

| 7. | Nazara Technolo. | 958.60 | 88.26 | 7336.91 | 16.24 | -1.86 | 318.94 | 7.30 | 5.53 |

| 8. | M T N L | 45.15 | 2849.28 | -890.28 | -12.29 | 174.23 | -11.93 | -8.18 |

| Period | Share Price (INR) |

|---|---|

| Before 1 Year | ₹35.30 |

| Before 6 Months | ₹48.94 |

| Before 5 Years | ₹12.70 |

| All-Time Max | ₹102 |

Mahanagar Telephone Nigam Limited (MTNL), a state-owned telecom provider operating primarily in Mumbai and Delhi, has fortunes decided by financial performance, government policies, market competition, and investor sentiment. Recently experienced economic challenges like nonpayment of interest payments might hurt MTNL’s share price.

Check Live Price here:

Mahanagar Telephone Nigam Limited (MTNL), which provides telecom services in Mumbai and Delhi, may experience share price fluctuation tomorrow depending on market demand, performance metrics, government policies, and investor interest. Factors such as high debt levels or an aged infrastructure are also factors. MTNL operates in an ultra-competitive telecom industry, which means this fluctuation could occur quickly or slowly. The price can be change from Rs 2 to 4.

| Price Type | Change |

|---|---|

| Maximum (₹) | + 4 |

| Minimum (₹) | – 2 |

MTNL Indicator Based Technical Analysis

NOTE!

Signals may differ across timeframes. If you’re planning to purchase MTNL and keep it for more than one week, it’s suggested that you choose signals from weekly and daily timeframes. For trading in the short term, signals that range from 5 minutes to 1-hour timeframes are better appropriate.

The MTNL share price target for 2025 is estimated at 25 to 70 rupees. This range depends on factors such as government support, network modernization, and possible privatization; performance depends on improving operational efficiency while reducing losses to benefit from growth in the Indian telecom market.

| Year | Minimum Price (₹) | Maximum Price (₹) | Remarks |

|---|---|---|---|

| 2025 | 25 | 70 | Fluctuates with market trends, policy changes, and financial updates. |

| Month | Minimum Price (₹) | Maximum Price (₹) | Remarks |

| January | 25 | 45 | Stable after recent news. |

| February | 28 | 40 | Slight rise in demand. |

| March | 30 | 42 | Optimism in telecom sector. |

| April | 27 | 38 | Minor profit-booking seen. |

| May | 26 | 37 | Debt concerns linger. |

| June | 29 | 45 | Positive market sentiment. |

| July | 32 | 50 | Fresh investments expected. |

| August | 30 | 48 | Growth anticipation grows. |

| September | 35 | 55 | Potential policy boost. |

| October | 38 | 60 | Optimistic quarterly results. |

| November | 40 | 65 | Renewed investor interest. |

| December | 45 | 70 | Year-end market rally. |

MTNL share price target for 2026 has been projected between Rs 50-120, reflecting expected network modernisation, improved service offerings, potential government reforms and positive growth in the Indian telecom sector, 5G rollout and strategic partnerships, all of which can support this projection if MTNL manages to increase profitability and efficiency.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2026 | 50 | 120 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 50 | 65 |

| February | 55 | 70 |

| March | 58 | 75 |

| April | 60 | 80 |

| May | 63 | 85 |

| June | 65 | 90 |

| July | 70 | 95 |

| August | 75 | 100 |

| September | 80 | 105 |

| October | 85 | 110 |

| November | 90 | 115 |

| December | 100 | 120 |

The target price for MTNL shares 2030 is between 220 and 270 rupees. This range reflects the expected growth driven by the expansion of 5G networks, rising demand for digital services, and government initiatives to restore state-owned telecom companies. Operational efficiency improvements, cost control measures, and strategic partnerships should help achieve this goal.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2030 | 220 | 270 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 220 | 240 |

| February | 225 | 250 |

| March | 230 | 255 |

| April | 235 | 260 |

| May | 240 | 265 |

| June | 245 | 270 |

| July | 250 | 270 |

| August | 255 | 270 |

| September | 260 | 270 |

| October | 265 | 270 |

| November | 265 | 270 |

| December | 270 | 270 |

MTNL estimates its share price target 2040 to be 520 to 690 rupees. This range reflects the growth potential from the increase in 6G technology, government support, and improved infrastructure. Investments in innovative city projects, IoT services, and high-speed internet connectivity are expected to drive demand and enable sustainable growth with long-term profitability.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2040 | 520 | 690 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 520 | 550 |

| February | 530 | 560 |

| March | 540 | 570 |

| April | 550 | 580 |

| May | 560 | 590 |

| June | 570 | 600 |

| July | 580 | 620 |

| August | 590 | 630 |

| September | 600 | 640 |

| October | 610 | 650 |

| November | 620 | 670 |

| December | 630 | 690 |

MTNL’s 2050 price target is estimated to be between Rs 1020 and Rs 1490, driven by the adoption of 7G technology, increased digital transformation efforts, and the company’s role as a supporter of national infrastructure. Through investments, government initiatives, and the expansion of telecom services, MTNL hopes to ensure long-term growth and profitability in an ever-evolving technology landscape.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2050 | 1020 | 1490 |

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 1020 | 1060 |

| February | 1040 | 1090 |

| March | 1060 | 1100 |

| April | 1080 | 1120 |

| May | 1100 | 1150 |

| June | 1120 | 1180 |

| July | 1150 | 1200 |

| August | 1170 | 1230 |

| September | 1200 | 1270 |

| October | 1230 | 1300 |

| November | 1260 | 1350 |

| December | 1300 | 1490 |

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 25 | 70 |

| 2026 | 50 | 95 |

| 2030 | 220 | 270 |

| 2040 | 520 | 690 |

| 2050 | 1020 | 1490 |

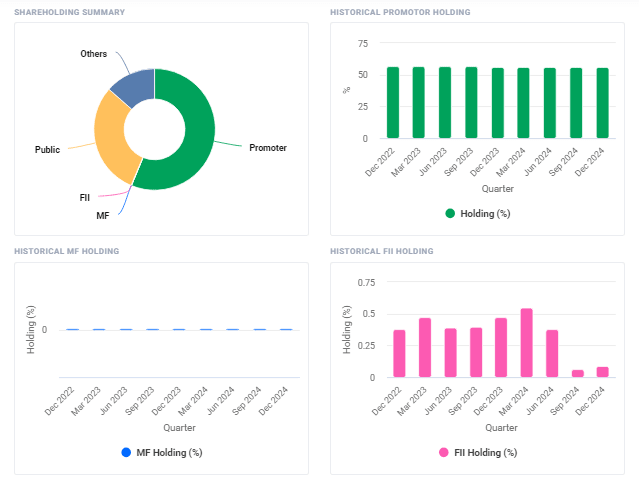

| Quarterly/Yearly | Dec 2024 |

|---|---|

| Promoters + | 56.25% |

| FIIs + | 0.09% |

| DIIs + | 13.49% |

| Public + | 30.16% |

| No. of Shareholders | 4,41,629 |

- Promoters’ share remains unchanged at 56.25% in Dec 2024.

- FII/FPI investors’ shares increased from 34 to 38 during this period, and the FII share increased by 0.06 to 0.09% of total investment.

- Mutual fund holdings remained unchanged in this quarter.

- Institutional investors increased their holdings from 13.53% to 13.58% in Dec 2024 QTR.

HFCL Share Price Target 2025, 2026, 2030, 2040, 2050

Buying MTNL shares depends on your risk appetite. While the company has potential with technological innovations such as 6G and 7G, financial instability and competition can present difficulties that must be considered before investing. Long-term investors with a high-risk appetite could consider this investment; however, keep an eye on market fluctuations!

MTNL Ltd Earning Results (Financials)

| Quarter | Revenue (₹ Cr) | Net Loss (₹ Cr) | EPS (₹) |

|---|---|---|---|

| Q3 FY2024 | 209 | -784 | -12.44 |

| Q2 FY2024 | 192 | -839 | -13.32 |

| Q1 FY2024 | 198 | -793 | -12.58 |

| Q4 FY2023 | 219 | -749 | -11.88 |

| Q3 FY2023 | 227 | -738 | -11.71 |

| Q2 FY2023 | 238 | -776 | -12.31 |

| Q1 FY2023 | 251 | -653 | -10.37 |

The quarterly financial results showed declining revenues and continued losses for the company, such as in Q3 FY2024 when revenues reached Rs209 crore. Losses totaled Rs784 crore, resulting in an EPS loss of -Rs12.44 per share, leading to a negative EPS result for FY2023. This loss trend continued throughout FY2023, with losses ranging from Rs653 crore to Rs839 crore throughout FY2023.

Vodafone Idea share Price Target 2025, 2026, 2030, 2040, 2050

Expert Forecasts On The Future Of MTNL Ltd.

MTNL Ltd. is currently facing challenges as revenues are falling and losses are rising, along with negative ROE and EBITDA figures that predict a slow recovery until a restructuring is undertaken or government support is granted. Last quarter, the company’s net profit was Rs-2,915 crore with an EPS of 52.27, suggesting financial distress and uncertain growth potential.

Is MTNL Stock Good to Buy? (Bull case & bear case)

Bullish Case:

- Possible government support for the regeneration of MTNL Ltd.

- Improved growth in the telecoms sector may benefit the MTNL.

- Potential restructuring and cost-cutting initiatives.

- MTNL Share value of money for a long-term investment if the turnaround occurs.

Bearish Case:

- Due to High debt and continuous losses.

- Due to Negative return on equity and declining revenues.

- Its Limited profitability with low EBITDA.

- Due to Uncertainty about management’s ability to execute a turnaround plan.

Bharti Airtel share Price Target 2025, 2026, 2030, 2040, 2050

Conclusion

MTNL is struggling with financial problems, such as high debt and losses. Due to this, we could hope for improvement with possible government support and expanding the telecoms industry. Long-term investors should remain cautious as a high-risk but high-reward option also available for Patience investors. Although a successful restructuring could promise significant returns, caution is advised, given MTNL’s current difficulties.